Chartered Professional Accountant

Sohail Afzal (CPA, CMA, MBA) is a Chartered Professional Accountant who has extensive experience in accounting and taxation. He is a highly experiencd businessman himself and understands the challenges that many businesses face when it comes to cash flow management. As an experienced business consultant & tax advisor, he is helping companies grow by providing the technical, financial, and contractual information necessary for strategic decision-making.

Sohail has been in the finance and accounting industry for many years. Because of his diverse client portfolio and background in business, he understands what businesses need and how to use legitimate tax strategies to reduce tax liability and maximize tax credits. Because of Sohail's business background, he is able to pair bookkeeping and tax services with management consulting providing an edge over other similar accounting firms which only focus on computing taxes.

Committed to the digital revolution, Sohail always prefers a little more communication and proximity with his clients for a more fluid sharing of information. "Our approach is always proactive, we always encourage our clients to reach out to us as many times as they want without any additional cost because we believe in establishing long-term & trustworthy relationships," he told the Toronto Star..

Latest Insights

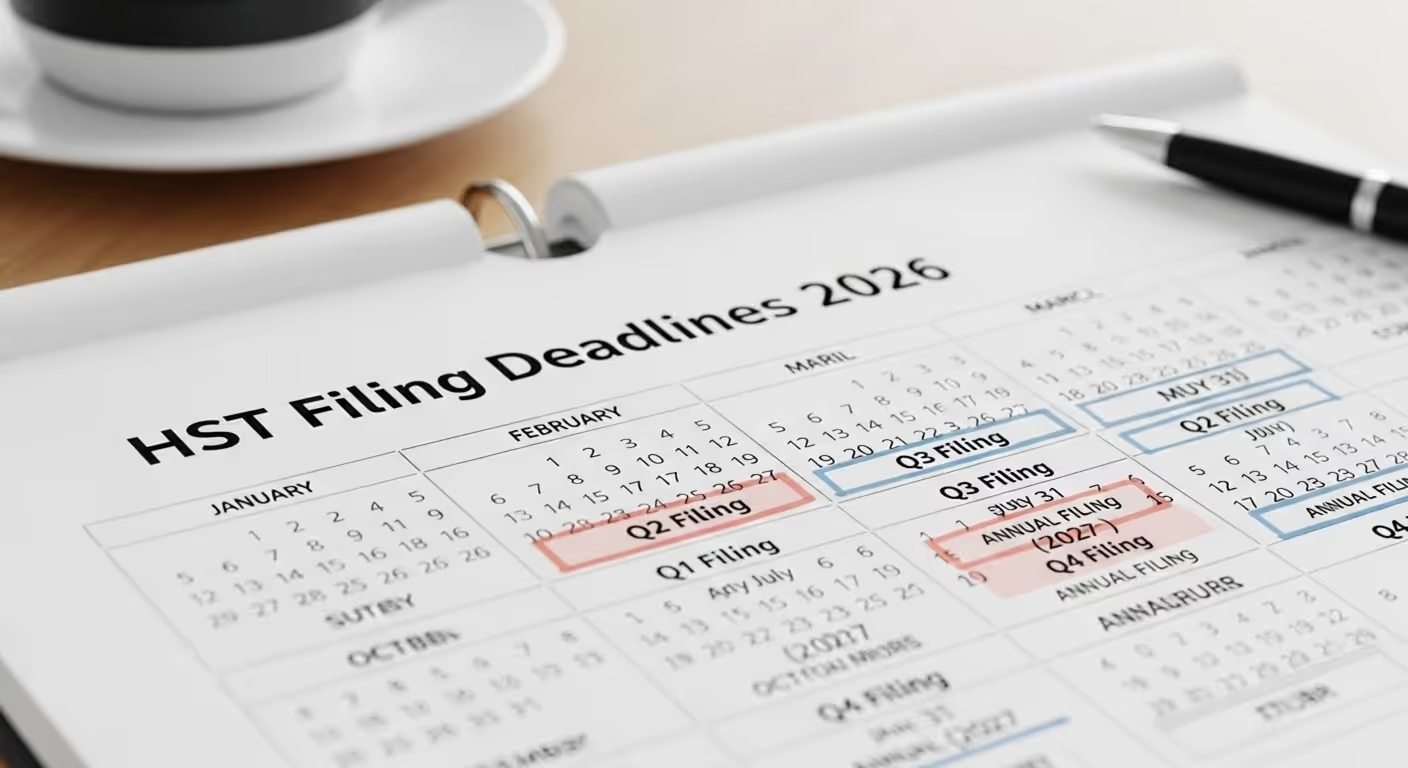

HST Filing Deadlines for 2026: A Complete Calendar for Ontario Businesses

For Ontario businesses, HST compliance is not optional. Missing a filing deadline or making a reporting error can lead to penalties, interest charges, cash flow issues, and unnecessary communication with the CRA. Many businesses face problems not because they avoid taxes, but because they do not fully understand when to file, how much to remit, or what information is required.

In 2026, with increased CRA enforcement and more digital reporting, businesses need better control over their tax and bookkeeping processes. Whether you are a sole proprietor, a growing corporation, or a professional service provider, knowing your HST filing schedule is critical for financial planning and compliance.

This guide provides a complete, Ontario-specific HST filing calendar for 2026, explains who must file, what is required for each return, and how businesses can reduce risk through proper bookkeeping, reporting, and professional support.

What Is HST and Who Must File?

The Harmonized Sales Tax (HST) is a 13% consumption tax in Ontario that combines federal GST and provincial sales tax. Most businesses that sell taxable goods or services must:

- Register for an HST account

- Charge HST on taxable sales

- Collect and remit HST to the CRA

- File HST returns on time

You are required to register if your business earns more than $30,000 in taxable revenue in a 12-month period. Voluntary registration is also allowed and may be beneficial if you want to claim input tax credits (ITCs).

HST Filing Frequencies

Your filing frequency is assigned by the CRA when you register:

You may also request a different filing frequency depending on your cash flow and administrative preferences.

HST Filing Deadlines for 2026

Below is the full HST calendar for Ontario businesses in 2026.

Monthly Filers

Monthly filers must submit their return and payment one month after the reporting period ends.

Quarterly Filers

Quarterly filers file one month after the quarter ends.

Annual Filers

Annual filers usually have the filing deadline three months after year-end, but the payment is due earlier.

What Information Is Required for HST Filing?

To file an accurate HST return, Ontario businesses must maintain clear and up-to-date financial records throughout the reporting period. Incomplete or inaccurate information is one of the most common reasons for CRA reassessments and penalties.

You will need the following details for each HST return:

- Total taxable sales: The total value of all sales that are subject to HST, excluding exempt or zero-rated supplies.

- Total HST collected: The actual HST charged and collected from customers during the reporting period.

- Input tax credits (ITCs): The HST you paid on eligible business expenses that can be claimed as a credit.

- Adjustments or corrections: Any changes from previous periods, such as bad debts or credit notes.

- Net tax payable or refund amount: The difference between HST collected and ITCs claimed.

Supporting documentation is equally important. You should retain:

- Sales invoices and receipts

- Expense receipts showing HST paid

- Bank and credit card statements

- Contracts and supplier invoices

Accurate bookkeeping is essential because the CRA expects your HST return to match your financial records. Even small errors can result in reviews, reassessments, or delays in receiving refunds.

Penalties for Late HST Filing

Failing to file or remit HST on time can quickly become expensive. The CRA applies both penalties and interest to overdue balances.

The standard penalties include:

- A 1% penalty on the outstanding balance as soon as the deadline is missed

- An additional 0.25% per month on the unpaid amount, for up to 12 months

- Daily compounded interest on the total balance owing

Beyond the financial cost, repeated late filings increase the risk of:

- CRA compliance reviews

- Formal audits

- Requests for supporting documentation

- Potential restrictions on your business account

Consistent late filings can also damage your credibility when applying for loans, government funding, or grants.

Common HST Filing Mistakes

Many Ontario businesses face HST issues not because of intentional non-compliance, but because of avoidable reporting mistakes.

Common problems include:

- Misclassifying taxable, zero-rated, and exempt sales

- Claiming ITCs on ineligible or personal expenses

- Missing a filing deadline or forgetting to file a period entirely

- Using the wrong reporting period or fiscal year

- Not reconciling sales and bank data before filing

- Poor record-keeping or missing receipts

These errors often result in reassessments, penalties, interest charges, and unnecessary time spent responding to CRA notices.

How to Stay Compliant in 2026

Staying compliant with HST requirements requires consistency and basic financial controls. Practical steps include:

- Using accounting software that tracks HST automatically

- Reconciling bank accounts and sales records monthly

- Keeping digital copies of all invoices and receipts

- Reviewing HST reports before each filing

- Setting calendar reminders for all filing and payment deadlines

- Reviewing CRA correspondence promptly

Many businesses choose to outsource these tasks to professionals who provide HST filing services, bookkeeping, and CRA compliance support. This reduces the risk of errors and ensures deadlines are not missed.

When Should You Use Professional Help?

You should consider working with a professional if:

- Your HST filings are inconsistent or confusing

- You are behind on returns or payments

- You have received a CRA review or audit notice

- Your business is growing, restructuring, or incorporating

- You operate in multiple provinces or have complex tax rules

Professional support helps ensure accurate reporting, timely filing, and proper handling of CRA correspondence.

This is where Gta Accounting can support Ontario businesses with accurate filings, reporting, and ongoing compliance.

Many Ontario business owners rely on Gta Accounting – HST Filing Services to manage their HST returns, bookkeeping, payroll reporting, and CRA communication efficiently.

Final Thoughts

HST compliance is a core responsibility for Ontario businesses. Understanding your filing frequency, deadlines, and reporting obligations helps you avoid penalties and maintain clean records with the CRA.

Use this 2026 HST calendar to plan ahead, stay organized, and ensure your business meets all filing requirements on time.

If your business needs support with HST filings, bookkeeping, or CRA compliance, professional guidance can help you stay focused on running your business while avoiding unnecessary tax issues.

Last-Minute Tax Moves Canadian Business Owners Can Still Make Before December 31, 2025

As December 31 approaches, many Canadian business owners believe tax planning is already off the table. In reality, several important decisions can still be made before year-end that directly affect how much tax your business pays and how smoothly your filings go with the CRA.

Year-end tax planning is not about shortcuts or aggressive tactics. It’s about reviewing your numbers, fixing gaps, and making informed decisions while there is still time. Even small adjustments — when done correctly — can reduce taxable income, improve compliance, and prevent problems during tax season.

This guide covers practical last-minute tax moves Canadian business owners can still make before December 31, focusing on actions that are realistic, compliant, and relevant for corporations and small businesses across Canada.

1. Review and Record All Outstanding Business Expenses

One of the most common year-end issues is incomplete expense records. Many businesses incur expenses throughout the year that never make it into the books, especially during busy months.

Before December 31, review your records to ensure all eligible 2025 expenses are properly recorded. This includes expenses you’ve already paid for as well as invoices received but not yet entered into your accounting system.

Examples include:

- Office supplies and software subscriptions

- Business-use portion of phone, internet, and vehicle costs

- Professional fees such as accounting, legal, and consulting services

- Marketing, advertising, and online tools

Accurately recording expenses reduces taxable income and prevents overpayment. However, expenses must be reasonable, business-related, and supported by documentation. Poorly categorized or unsupported expenses increase CRA audit risk.

2. Make the Right Owner Compensation Decision Before Year-End

For incorporated businesses, how you pay yourself matters just as much as how much you earn.

December is often the final opportunity to decide whether paying yourself through salary, bonus, or dividends makes sense for the current tax year. Each option has different tax consequences at both the corporate and personal level.

Key factors to review include:

- Your personal tax bracket

- Corporate taxable income

- CPP contribution requirements

- Cash flow availability

A bonus declared before December 31 may still be deductible to the corporation, even if paid shortly after year-end, provided it is structured correctly. Making this decision late — or not at all — often results in missed planning opportunities or higher overall taxes.

3. Write Off Uncollectible Accounts Receivable

If your business invoiced customers in 2025 and there is little chance of collecting payment, you may be able to deduct those amounts as bad debts.

Before year-end, review your accounts receivable aging report and identify invoices that are genuinely uncollectible. The CRA expects businesses to make reasonable efforts to collect outstanding amounts before claiming a bad debt.

Writing off bad debts:

- Reduces taxable income

- Keeps financial statements accurate

- Prevents overstated revenue

Failing to address uncollectible receivables can inflate profits and lead to unnecessary tax payments.

4. Review GST/HST Accuracy Before Closing the Books

GST/HST mistakes are one of the most common triggers for CRA reviews. December is the right time to identify and correct issues before filings are finalized.

A proper year-end GST/HST review should include:

- Matching GST/HST collected to sales records

- Verifying tax rates applied correctly

- Identifying missed input tax credits (ITCs)

- Correcting posting or classification errors

Fixing errors before year-end is far easier than responding to CRA notices later. This step is especially important for businesses with high transaction volumes or multiple revenue streams.

5. Consider Capital Asset Purchases With Business Purpose

If your business genuinely needs equipment or technology, purchasing it before December 31 may allow you to start claiming capital cost allowance (CCA) sooner.

Common examples include:

- Computers and office equipment

- Machinery and tools

- Business-use vehicles

While tax deductions can be helpful, purchases should never be made solely for tax savings. The asset must serve a real business purpose and align with your operational needs.

6. Clean Up Bookkeeping Before Year-End

Disorganized books create problems long after December ends. Inaccurate records lead to higher accounting costs, filing delays, and increased CRA risk.

Before year-end, businesses should:

- Reconcile bank and credit card accounts

- Review uncategorized or suspense transactions

- Separate personal and business expenses

- Ensure revenue is recorded in the correct period

Clean books make tax planning more effective and reduce the likelihood of adjustments later. This step is critical for businesses planning to grow or seek financing in the coming year.

7. Review Payroll and Source Deduction Compliance

Payroll errors are costly and often discovered too late.

Before December 31, confirm that:

- Employees and contractors are classified correctly

- CPP and EI deductions are accurate

- Owner payroll is recorded properly

- Payroll records align with remittance filings

Errors in payroll reporting can lead to penalties, interest, and CRA scrutiny — even when mistakes are unintentional. Addressing issues now prevents problems during T4 and T4A preparation.

8. Assess Income Timing and Deferral Options

In some cases, it may be possible to defer income into the next tax year, depending on your accounting method and business structure.

This may involve:

- Reviewing invoicing timing

- Confirming revenue recognition policies

- Ensuring compliance with CRA rules

Income deferral must be handled carefully. Improper deferral can result in reassessments and penalties, so professional review is strongly recommended.

9. Confirm Losses and Credits Are Properly Tracked

If your business has non-capital losses, capital losses, or unused tax credits, year-end is the right time to confirm they are recorded accurately.

These amounts can significantly reduce future tax obligations, but only if they are tracked and applied correctly. Missing or misreported losses often go unused, resulting in higher taxes down the line.

10. Get Professional Review Before December 31

The biggest mistake business owners make is waiting until tax season to ask questions. By then, most year-end planning opportunities are gone.

Working with a professional before December 31 allows time to:

- Identify missed deductions

- Correct reporting issues

- Structure owner compensation properly

- Reduce CRA compliance risk

GTA Accounting supports Canadian businesses with year-end accounting, tax planning, bookkeeping, and payroll review to ensure decisions are accurate and compliant. In many cases, even a short review before year-end can prevent costly mistakes later.

Final Thoughts

Year-end tax planning is about preparation, not pressure. What you review — or ignore — before December 31 directly affects your tax position and compliance in 2026.

If your expenses are incomplete, your books are not reconciled, or your owner compensation has not been reviewed, there may still be time to fix it — but the window is closing.

Acting now puts your business in a stronger position for the year ahead.

How to Get Ready for Year‑End: Tax & Financial Checklist for Canadian Small Businesses in 2025

For small business owners in Canada, year-end is one of the most important times of the year for accounting, bookkeeping, and tax planning. Proper preparation ensures that your financial records are accurate, tax filings are on time, and your business remains compliant with the Canada Revenue Agency (CRA) rules. By following a structured checklist, you can avoid last-minute stress, reduce errors, and even save money on taxes.

This guide provides a detailed tax and financial checklist for Canadian small businesses, highlighting the key steps you should take to close your fiscal year efficiently. Whether you are a sole proprietor, partnership, or corporation, this information will help you stay organized and ready for year-end reporting.

1. Review Your Accounting Records

Start by reviewing all your accounting records for the year. Make sure all financial transactions are accurately recorded in your accounting software or ledgers. Check the following:

- Ensure all invoices and receipts are accounted for.

- Match bank statements with bookkeeping records to detect errors or missing transactions.

- Categorize expenses properly to take advantage of eligible deductions.

Accurate records form the foundation for preparing financial statements and filing taxes. Errors at this stage can lead to audit risks or missed opportunities for deductions.

2. Reconcile Bank and Credit Card Accounts

Reconciliation is essential to confirm that your financial statements match your bank and credit card accounts. Follow these steps:

- Compare monthly bank statements with your accounting records.

- Identify discrepancies such as unrecorded transactions, double entries, or missing payments.

- Adjust records where necessary to ensure accuracy.

Reconciling accounts helps prevent errors in financial statements and ensures that all transactions are captured before preparing tax returns.

3. Review Accounts Receivable and Payable

A year-end review of receivables and payables ensures you know what money is coming in and going out.

- Accounts Receivable: Identify overdue invoices and send reminders to clients. Consider writing off bad debts if necessary.

- Accounts Payable: Review outstanding bills and schedule payments to avoid penalties or interest.

By reviewing these accounts, you maintain accurate cash flow records and ensure your financial statements reflect the true state of your business.

4. Inventory Check (If Applicable)

If your business manages inventory, perform a thorough year-end count.

- Physically count all inventory items.

- Adjust accounting records to reflect actual inventory levels.

- Write off obsolete or damaged stock.

Proper inventory management ensures your cost of goods sold (COGS) is accurate, which directly impacts your taxable income.

5. Review Fixed Assets and Depreciation

Fixed assets such as equipment, vehicles, and property need to be reviewed before year-end.

- Verify the existence and condition of each asset.

- Calculate and record depreciation accurately in your accounting system.

- Consider any capital asset purchases or disposals during the year.

Recording depreciation correctly ensures that you maximize your allowable deductions and maintain proper financial statements.

6. Payroll Review

Payroll is a critical area for small businesses. At year-end, verify that all payroll records are complete and accurate.

- Ensure all employee salaries, bonuses, and deductions are recorded.

- Verify Canada Pension Plan (CPP), Employment Insurance (EI), and income tax withholdings.

- Prepare T4 slips for employees and T4A slips for contractors.

Accurate payroll records prevent CRA penalties and help employees file their personal taxes correctly.

7. Evaluate Tax Deductions and Credits

Take time to review all potential tax deductions and credits available to your business. Common deductions for Canadian small businesses include:

- Office supplies and equipment

- Vehicle expenses

- Travel and business meals (limited)

- Professional fees and services

Additionally, explore federal and provincial tax credits, such as the Scientific Research & Experimental Development (SR&ED) credit or digital media incentives. Planning ahead allows you to reduce taxable income and optimize tax savings.

8. Prepare Financial Statements

Financial statements provide a clear picture of your business’s performance and are essential for tax filing. Year-end statements include:

- Income Statement (Profit & Loss Statement): Shows revenue, expenses, and net profit.

- Balance Sheet: Lists assets, liabilities, and equity.

- Cash Flow Statement: Tracks inflows and outflows of cash.

Accurate financial statements also help with loan applications, investor reporting, or business valuation.

9. Plan for Tax Payments

After reviewing your financial statements, estimate your tax liability for the year.

- Calculate federal and provincial income taxes.

- Consider installment payments if your business is required to make them.

- Allocate funds for GST/HST, payroll remittances, or other applicable taxes.

Proactive planning ensures that you have sufficient funds to meet tax obligations without impacting cash flow.

10. Review Retirement Contributions and Benefits

If your business offers employee benefits or retirement plans:

- Confirm contributions to RRSPs, pensions, or other benefit plans.

- Ensure all eligible expenses are recorded for tax purposes.

- Review benefit plan compliance with CRA regulations.

Proper management of benefits can reduce taxable income and maintain employee satisfaction.

11. Audit Preparedness

Even if your business has not been audited before, preparing for potential CRA audits is prudent.

- Keep supporting documents for all financial transactions.

- Maintain organized records for expenses, invoices, and contracts.

- Ensure financial statements accurately reflect the business’s financial position.

Being prepared reduces the risk of penalties and makes audits more manageable.

12. Review and Update Accounting Policies

Year-end is an ideal time to review your accounting policies and internal controls.

- Update expense approval processes.

- Review bookkeeping procedures and software efficiency.

- Ensure compliance with accounting standards applicable to Canadian businesses.

Strong accounting policies improve accuracy and consistency in financial reporting.

13. Seek Professional Services Support

Many small businesses benefit from professional accounting services at year-end. Services may include:

- Bookkeeping and record reconciliation

- Tax planning and filing

- Payroll management

- Financial statement preparation

- Audit support

Working with experienced professionals ensures compliance, saves time, and reduces errors. GTA Accounting offers these services tailored for Canadian small businesses.

Conclusion

Year-end preparation is a critical task for Canadian small businesses. By reviewing accounting records, reconciling accounts, managing payroll, and planning for taxes, you can close your fiscal year with confidence. Following this checklist helps prevent mistakes, ensures compliance, and may even save money on taxes.

For businesses looking for guidance, professional accounting services can make year-end preparation more efficient and accurate. At GTA Accounting, we provide comprehensive services to help small businesses across Canada manage their finances, file taxes, and stay compliant.

Rental Income Taxes in Burnaby — Why Landlords Are Hiring Professional Tax Accountants

Rental properties are a steady income source in Burnaby, especially with the city’s growing demand for housing. But earning rental income also means handling tax obligations under the Canada Revenue Agency (CRA). Many Burnaby landlords are learning that rental income taxes are not as simple as adding revenue to an income tax return. There are rules, deductions, forms, and reporting requirements that can affect how much tax must be paid. A small error can lead to penalties or an audit.

This is why more landlords in Burnaby are turning to professional tax accountants instead of filing rental income taxes on their own. The goal is simple: remain compliant and reduce unnecessary tax payments.

Understanding Rental Income Tax in Canada

Rental income is taxable in Canada. Whether you rent out a full house, condo, apartment unit, basement suite, secondary suite, or even a short-term rental such as Airbnb, the CRA requires you to report all income. If you earn rental income in Burnaby, it must be included on your income tax return.

However, landlords are not taxed on the total rental revenue. Taxes apply on net rental income ─ rental income minus eligible rental expenses.

Examples of expenses that can reduce tax owed include:

- Mortgage interest (not principal)

- Property taxes

- Utilities (if paid by you)

- Insurance premiums

- Repairs and maintenance

- Advertising

- Property management fees

- Legal fees for tenant matters

- Depreciation (Capital Cost Allowance)

The challenge for most landlords is knowing what counts as an eligible expense and what the CRA may reject.

Why Landlords in Burnaby Are Hiring Professional Tax Accountants

Landlords are aware that rental income and taxes are becoming more complex every year, especially with continuous CRA updates. Below are the main reasons why professional help has become common among rental property owners in Burnaby.

1. Avoiding Costly CRA Mistakes

Many landlords are unsure how rental income should be reported. Common mistakes include:

- Deducting capital improvements as repairs

- Forgetting to claim depreciation or claiming it incorrectly

- Not allocating shared expenses for basement suites properly

- Improper use of home office deductions

- Not reporting short-term rental income from Airbnb or VRBO

- Not filing rental income for vacant months with expenses

These mistakes can trigger reassessment or an audit. A tax accountant ensures everything is filed correctly based on CRA rules.

2. Maximizing Deductions Legally

Landlords in Burnaby often miss out on deductions because they are unaware of all eligible write-offs. Even small deductions add up over a full year.

Examples where a tax accountant can reduce taxable income:

- Converting a portion of personal home expenses when renting a legal basement suite

- Tracking prorated repairs that apply to both personal and tenant areas

- Classifying appliances and renovations correctly as capital assets

- Claiming mileage for landlord duties

- Deducting condo fees related to the rental portion

The difference can be thousands of dollars in tax savings every year.

3. Short-Term Rental Rules in Burnaby (Airbnb / VRBO)

Many Burnaby landlords renting units short-term are unsure whether rental income is taxed as:

- Rental income, or

- Self-employment income

A tax accountant determines the correct classification. This matters because deductions, GST/PST requirements, and tax rates can change depending on the classification. CRA monitors short-term rental platforms, so accurate reporting is important for compliance.

4. Basement Suites and Secondary Units

Burnaby has a high number of legal and illegal basement suites. Taxes vary depending on whether the property is:

- Fully rented

- Partially rented

- Owner-occupied with tenant space

A tax accountant determines the correct percentage allocation for utilities, mortgage interest, insurance, property tax, repairs, and other shared expenses. Without proper allocation, CRA can reject deductions or charge penalties.

5. Corporate vs Personal Ownership

Some landlords buy properties under a corporation to reduce tax costs. Others own them personally and pay rental income tax at individual tax rates. With rising property values in Burnaby, the question of whether to incorporate for rental property has become common.

A tax accountant can assess:

- Current income

- Long-term growth plan

- Rental portfolio size

- Retirement plans

The decision impacts tax rates, legal liability, capital gains, and estate planning.

6. Capital Gains and Sale of Rental Property

Many Burnaby property owners plan to sell in the future to take advantage of property appreciation. The timing and tax treatment of the sale are important.

A tax accountant supports:

- Calculating capital gains

- Claiming adjusted cost base with renovations

- Tracking purchase closing costs and selling expenses

- Determining whether the principal residence exemption can apply to part of the property (for basement suite owners)

Incorrect reporting can cost thousands of dollars at the time of sale.

Why DIY Filing Tools Are Not Enough for Rental Income

Many landlords try filing rental income taxes using online calculators and basic tax software. These tools do not apply CRA rules for:

- Pro-rated deductions

- Capital vs repair classification

- Multiyear depreciation

- Partial rental of a principal residence

- Refinancing adjustments to mortgage interest

Because of these limitations, landlords may either:

- Pay more tax than necessary, or

- File incorrectly and risk reassessment

A tax accountant handles every detail while ensuring full compliance and maximum deductions.

Non-Resident Landlords

Some Burnaby rental property owners live outside Canada. In these cases, rental income tax becomes more complex because withholding rules apply. The CRA may require 25% of the gross rental income to be withheld if proper paperwork is not filed.

A tax accountant ensures:

- NR6 filing for reduced withholding tax

- Section 216 return for annual reporting

- Correct payer-agent designations

This saves non-resident property owners from excess withholding or CRA disputes.

When Should a Burnaby Landlord Contact a Tax Accountant?

Landlords benefit from professional support when:

- Renting a property for the first time

- Renting a basement suite or secondary unit

- Running a short-term rental (Airbnb / VRBO)

- Owning more than one rental property

- Unsure about eligible deductions

- Planning to sell the property

- Receiving a CRA letter or audit notification

- Living outside Canada but earning rental income

In most cases, the savings from deductions and compliance outweigh the accountant’s fees.

Final Thoughts

Rental income taxes in Burnaby require careful planning and accurate reporting. Between deductions, capital cost allowance, expense classification, shared-space allocation, and CRA rules for landlords, preparing tax returns without professional help can lead to higher taxes or penalties. This is why many Burnaby property owners now prefer working with a Tax Accountant in Burnaby to manage their rental income taxes and ensure compliance while reducing tax costs.

If you want professional guidance with rental income taxes or need help filing your return correctly, GTA Accounting provides complete rental property tax support for landlords across Burnaby and British Columbia.

Law Firm Accounting Services: Essential Solutions for Canadian Legal Practices

Managing a law firm requires more than providing excellent legal advice. Behind every successful practice lies a strong financial foundation built on compliance, accuracy, and efficiency. Law firm accounting is unlike general accounting — it involves handling client trust funds, managing retainers, and ensuring compliance with Law Society regulations.

This guide explores the key aspects of Law Firm Accounting Services in Canada, the challenges legal practices face, and how professional accounting partners such as GTA Accounting can help law firms maintain financial integrity and regulatory compliance.

Why Law Firms Need Specialized Accounting Services

Challenges Unique to Legal Practices

Law firms operate under a unique financial model. Unlike regular businesses that manage simple income and expenses, law firms must adhere to complex accounting structures and regulations.

One of the most critical aspects is trust accounting — managing money that belongs to clients but is temporarily held by the firm. These funds must be kept separate from the firm’s own operating account, and every transaction must be properly recorded and reconciled.

Legal practices also deal with billable hours, retainers, and case-based billing, which require precise bookkeeping. Errors in these areas can lead to client disputes, compliance violations, or even penalties from the Law Society.

In addition, tax reporting and payroll management for partners and associates often involve unique structures like draws or profit sharing, which demand specialized expertise.

Key Services Offered to Law Firms

Professional accounting firms offer a range of services designed to meet the specific needs of legal practices. These services ensure compliance, improve financial clarity, and allow law firms to focus on serving their clients.

1. Bookkeeping and Financial Management

Accurate bookkeeping is the foundation of every law firm’s financial success. Professional accountants manage daily transactions, reconcile accounts, track expenses, and generate financial statements.

With dedicated law firm bookkeeping, partners gain clear visibility into revenue, overhead, and profitability — helping them make better business decisions.

2. Trust Accounting and Client Fund Management

Trust accounts are one of the most sensitive parts of law firm operations. Accountants experienced in trust accounting for law firms handle deposits, withdrawals, and reconciliations in strict compliance with Law Society rules.

This includes maintaining detailed records of client trust ledgers, ensuring that no trust funds are ever used for operational expenses, and reconciling accounts monthly to prevent discrepancies.

3. Tax Planning and Compliance

Law firms face complex tax obligations depending on their structure — whether they operate as partnerships, professional corporations, or sole proprietorships. Specialized accountants develop tax planning strategies to minimize liabilities while ensuring compliance with the Canada Revenue Agency (CRA).

This includes preparing T2 corporate returns, HST filings, and managing deductions related to business operations, technology, and staff compensation.

4. Payroll and Employee Benefits Administration

Payroll for legal staff and partners often involves different structures such as salary, draws, and bonuses. Accountants ensure payroll accuracy, manage withholdings, and oversee contributions to employee benefit plans.

Automated payroll systems and compliance monitoring help firms stay efficient and avoid penalties related to employment taxes.

5. Financial Reporting and Analysis

Law firm accounting is not just about record-keeping — it’s also about strategic insight. Accountants provide regular financial reports, including balance sheets, income statements, and cash flow analysis.

These reports give partners valuable visibility into the firm’s performance, helping them make informed decisions on resource allocation, billing structures, and growth opportunities.

How Trust Accounting Works in Canadian Law Firms

Understanding Trust Accounts (IOLTA)

In Canada, law firms use Interest on Lawyers’ Trust Accounts (IOLTA) or general trust accounts to hold client funds. These funds can include retainers, settlements, or advance payments for legal services.

Trust money must never be mixed with the firm’s own operating funds. Law Societies in each province set strict rules on how trust money should be managed, documented, and reported.

Compliance Requirements

Every law firm must:

- Maintain detailed records for each client’s trust account

- Reconcile trust accounts monthly

- Keep all supporting documents, such as deposit slips and client ledgers

- Report any discrepancies immediately

Non-compliance with trust accounting rules can lead to audits, fines, or even suspension of the firm’s licence.

Professional firms specializing in client trust fund management help law practices maintain accuracy and compliance across all transactions.

Benefits of Outsourcing Law Firm Accounting

Outsourcing accounting functions to professionals who understand the legal industry offers several benefits.

1. Cost Savings

Hiring an in-house accountant or finance department can be costly for small and mid-sized law firms. Outsourcing reduces overhead by allowing firms to pay only for the services they need — without the expense of full-time staff.

2. Time Efficiency

Lawyers can focus on their core responsibilities — representing clients and managing cases — while professionals handle accounting tasks efficiently and accurately.

3. Improved Accuracy

Accounting firms use specialized tools and processes to reduce errors, ensuring all transactions are recorded correctly and trust accounts remain compliant.

4. Compliance Assurance

With ever-changing CRA and Law Society requirements, outsourced accountants keep your firm aligned with current regulations.

Common Accounting Challenges for Law Firms

Even established firms face unique financial and operational challenges that require specialized solutions.

1. Managing Billable Hours and Revenue Recognition

Law firms rely heavily on billable hours, which must be tracked accurately. Mismanagement can lead to revenue loss or disputes with clients.

Professional accounting systems help record and reconcile time-based billing with client payments, ensuring transparency and efficiency.

2. Retaining Clients’ Funds and Trust Management

Handling client retainers responsibly is crucial. Mixing client funds with operating funds, even accidentally, can result in disciplinary action. Specialized trust accounting systems and monthly reconciliations prevent such issues.

3. Managing Multiple Accounts and Entities

Large firms often operate multiple practice areas or partnerships. Managing separate financials for each entity — along with consolidated reporting — is complex. Accountants specializing in legal practice accounting streamline this process.

How GTA Accounting Supports Canadian Law Firms

GTA Accounting provides specialized Law Firm Accounting Services tailored to meet the unique financial and compliance needs of Canadian law practices.

1. Tailored Accounting Solutions

Every law firm operates differently. GTA Accounting customizes solutions for trust accounting, tax filing, and financial management, ensuring accuracy and compliance at every step.

2. Tax Planning and Reporting

With in-depth experience in accounting for law firms in Canada, GTA Accounting ensures that all deductions, credits, and filings align with CRA and provincial regulations. They also assist firms in optimizing their tax positions for maximum savings.

3. Cloud-Based Accounting Systems

The firm uses modern accounting software and cloud solutions, enabling real-time access to financial data, trust account balances, and reports — ensuring partners always have full visibility.

By partnering with GTA Accounting Group, law firms can maintain financial accuracy, reduce risk, and focus on their clients with confidence.

Choosing the Right Accounting Partner for Your Law Firm

When selecting an accounting firm, law practices should evaluate the following factors:

1. Industry Experience

Choose a firm with proven experience in law firm accounting. They should understand trust compliance, Law Society requirements, and the complexities of legal billing.

2. Compliance Knowledge

Regulations vary across provinces. Your accounting partner must have a strong understanding of local rules — including trust reconciliation and reporting requirements.

3. Software Expertise

Law firms benefit from accounting partners familiar with legal management software such as Clio, PCLaw, or QuickBooks for Lawyers. Integration between billing and accounting systems ensures seamless workflows.

4. Communication and Transparency

Reliable accountants maintain open communication, provide regular updates, and ensure you always understand your firm’s financial position.

A trusted accounting partner does more than manage numbers — they help you maintain compliance, protect client funds, and make strategic business decisions.

Conclusion

Accurate accounting is vital to every law firm’s success. From managing client trust funds to meeting CRA and Law Society requirements, specialized accounting ensures compliance and financial stability.

Outsourcing these responsibilities to experts like GTA Accounting provides peace of mind, operational efficiency, and cost savings.

If you’re a Canadian law firm seeking reliable and compliant accounting solutions, GTA Accounting offers the experience and expertise to support your growth.

Contact GTA Accounting today to learn more about tailored accounting services for your legal practice.

Tax Planning Tips for Canadians with Overseas Investments

Why Overseas Tax Planning Matters for Canadians

As more Canadians explore opportunities beyond national borders, investments in foreign markets have become increasingly common. Many individuals now hold U.S. stocks, real estate, or international business interests. While these global opportunities can lead to strong financial growth, they also bring added tax responsibilities. Managing and reporting foreign income properly is essential to remain compliant with the Canada Revenue Agency (CRA) and to avoid double taxation.

In Canada, foreign investment income—whether from dividends, property, or capital gains—is fully taxable. This means that even if income is earned outside Canada, residents are required to declare it on their Canadian tax return. Failure to do so can lead to penalties, reassessments, or even audits by the CRA. Understanding how foreign investment tax in Canada works and how the Canada–U.S. tax treaty impacts your returns is critical for sound tax planning.

This guide outlines essential tax planning tips for Canadians with overseas investments, focusing on U.S. assets, cross-border taxation, and strategies to legally minimize tax liabilities. Whether you own property in the U.S., invest through an RRSP, or hold international stocks, a structured tax plan can help you protect your returns and remain compliant.

Understanding How Canada Taxes Foreign Investment Income

The CRA requires Canadian residents to report all worldwide income, regardless of where it’s earned. This includes dividends, interest, and capital gains from foreign investments.

Foreign investment income is generally taxed in the same way as domestic income, but with additional reporting requirements. When you receive income from abroad, you may already have paid withholding tax in that foreign country. Canada typically allows you to claim a foreign tax credit to avoid being taxed twice on the same income.

How Are Foreign Dividends and Capital Gains Taxed in Canada?

- Foreign dividends: These are fully taxable in Canada. Unlike Canadian dividends, which receive a dividend tax credit, foreign dividends do not qualify for the same benefit.

- Capital gains: If you sell foreign stocks or property for a profit, 50% of the gain is taxable in Canada, similar to domestic capital gains.

- Foreign exchange impact: When reporting gains or losses, Canadians must convert the transaction amounts into Canadian dollars using the exchange rate at the time of sale.

Reporting Requirements for Foreign Income Under the CRA

If you hold more than CAD $100,000 in foreign property or investments, you must file Form T1135 (Foreign Income Verification Statement) annually. This includes U.S. real estate, foreign bank accounts, and shares in non-resident corporations. Non-compliance can result in substantial penalties.

Tax Implications for Canadians Investing in the U.S.

Many Canadians invest in the U.S. due to its stable economy and attractive stock market. However, these investments come with specific tax rules.

US Withholding Tax on Dividends and Investments

When Canadian residents earn dividends from U.S. corporations, a 15% U.S. withholding tax is typically applied under the Canada–U.S. tax treaty. For example, if you earn USD $1,000 in dividends from a U.S. company, USD $150 is withheld before payment.

In Canada, you must still report the full USD $1,000 as income on your tax return. The U.S. tax withheld can be claimed as a foreign tax credit to reduce your Canadian tax liability.

TFSA holders should note that the treaty does not protect them from this 15% withholding tax, while RRSPs are exempt under the treaty. This distinction is critical in choosing where to hold U.S. investments.

Capital Gains Tax for Canadians Selling U.S. Property

When a Canadian sells property in the U.S., the Internal Revenue Service (IRS) withholds 15% of the gross sale price as a temporary tax measure. The seller must then file a U.S. tax return to report the sale and claim a refund if the actual tax owed is less.

In Canada, capital gains on U.S. property must also be reported. However, you can claim a foreign tax credit for any tax paid to the U.S., preventing double taxation. This is one of the most complex areas of cross border taxes, and professional help from an accountant familiar with both CRA and IRS regulations is highly recommended.

How the Canada–U.S. Tax Treaty Reduces Double Taxation

The Canada–U.S. Income Tax Treaty plays an essential role in ensuring that Canadians with U.S. income are not taxed twice on the same earnings. It outlines how different income types—such as dividends, interest, and pensions—are taxed and which country has the right to collect.

Withholding Tax Rates Under the Canada–U.S. Tax Treaty

The treaty reduces the U.S. withholding tax rate from 30% to 15% for Canadian residents. This applies to most dividends, interest income, and royalty payments. For registered accounts like RRSPs, the withholding tax is often reduced to zero.

How to Claim Foreign Tax Credits in Canada

Canadians can claim a foreign tax credit on their tax return (Form T2209) to offset taxes already paid abroad. This ensures they are not taxed twice on the same income. The credit is usually limited to the lesser of:

- The foreign tax paid, or

- The Canadian tax payable on that foreign income.

Using RRSPs and TFSAs for U.S. Investments

Both the Registered Retirement Savings Plan (RRSP) and Tax-Free Savings Account (TFSA) are popular among Canadians, but they differ greatly when it comes to U.S. investment taxation.

RRSP and U.S. Dividend Tax Advantages

Under the Canada–U.S. tax treaty, U.S. dividends paid into an RRSP are exempt from withholding tax. This makes RRSPs the most tax-efficient account for holding U.S. stocks. Additionally, you do not pay Canadian tax until you withdraw funds from your RRSP.

TFSA and U.S. Dividend Tax Limitations

Unlike RRSPs, TFSAs are not recognized by the U.S. for tax treaty benefits. As a result, a 15% U.S. withholding tax applies to all dividends earned on U.S. holdings inside a TFSA. The CRA does not allow you to claim a foreign tax credit for taxes withheld within a TFSA, effectively reducing your net return.

Common Mistakes Canadians Make with Overseas Investments

Many Canadian investors unintentionally make reporting or planning errors that increase their tax liability or trigger CRA reviews. Common issues include:

- Failing to report income from U.S. or foreign accounts

- Assuming TFSAs are tax-free internationally

- Ignoring withholding tax rules and treaty benefits

- Not filing Form T1135 when required

- Misunderstanding how capital gains tax (U.S. vs Canada) applies to real estate or shares

These mistakes can result in penalties and lost opportunities for tax savings.

Professional Tax Planning Strategies to Minimize Taxes

Effective tax planning ensures compliance while legally minimizing the total tax burden across both jurisdictions. Some practical strategies include:

Structuring Investments to Reduce Withholding Tax

Holding U.S. assets in an RRSP can eliminate the 15% dividend withholding tax. Canadians should prioritize RRSPs over TFSAs or non-registered accounts for dividend-paying U.S. stocks.

Claiming Foreign Tax Credits and Avoiding Double Taxation

Keep detailed records of all foreign taxes paid. This allows you to claim accurate foreign tax credits on your Canadian return, reducing overall tax owed.

Timing the Sale of Foreign Assets

Selling property or shares strategically—such as in a lower-income year—can reduce exposure to capital gains tax in Canada. If you expect a refund from the U.S. IRS for withheld amounts, ensure timely filing to align with CRA deadlines.

Seeking Professional Help for Cross Border Taxes

Firms like GTA Accounting specialize in cross border tax planning, corporate tax, and personal tax filing for individuals with U.S. or global assets. Their guidance ensures compliance with both CRA and IRS requirements while identifying deductions and credits that lower your effective tax rate.

When to Consult a Cross-Border Tax Expert

If you regularly earn income from U.S. sources, own property abroad, or hold more than CAD $100,000 in foreign investments, working with a cross border tax accountant is essential. The rules surrounding foreign investment tax in Canada and the Canada–U.S. tax treaty can be complex. A professional accountant can help you:

- File all required forms and foreign income reports correctly

- Optimize tax outcomes between CRA and IRS filings

- Avoid double taxation through strategic credit use

- Plan withdrawals from RRSPs efficiently to minimize taxes

GTA Accounting provides complete cross-border tax solutions for individuals and businesses across Canada. Their experienced tax professionals understand both Canadian and U.S. regulations, helping clients stay compliant and tax-efficient.

Conclusion — Plan Smart, Save More on Global Investments

Global investing offers Canadians many advantages, but it also adds a layer of tax complexity that requires proper planning. By understanding how foreign investment income is taxed, using RRSPs strategically, and applying Canada–U.S. tax treaty provisions effectively, investors can retain more of their returns while remaining compliant.

Whether you’re earning U.S. dividends, selling property abroad, or managing multiple international accounts, professional guidance is the key to tax efficiency. GTA Accounting helps Canadians navigate all aspects of cross border taxes, personal and corporate tax planning, and CRA reporting — ensuring peace of mind with every investment decision.