Understanding and dealing with the Goods and Services Tax (GST) and Harmonized Sales Tax (HST) is pivotal for Canadian businesses, everything being equal. These taxes influence practically every exchange your business participates in, making it crucial to handle their subtleties to guarantee consistency and upgrade your monetary methodologies. This guide means to improve on GST/HST for entrepreneurs, featuring central issues to consider and how cooperating with a respectable bookkeeping firm can smooth out this part of your business tasks.

GST/HST Overview

The GST, which is a federal sales tax, is assessed at the same level nationwide of 5%. There are some provinces in which the GST is in one with the provincial sales tax (PST) leading to the creation of a harmonized sales tax (HST), which involves the combination of both taxes. The HST rates are different from one respective province to another, falling between 13% and 15%.

Communicating whether to charge GST, HST, or PST depends on the province in which you conduct business as well as the description of your goods and services.

Registration Requirements

Companies that are set to record more than $30,000 in taxable sales at the annual level are obligated to have a GST/HST. Following registration, this represents a fiduciary duty for you to gather tax on any taxable sales from Canadian goods and services. Small businesses with sales that do not exceed the ceiling threshold can choose to register voluntarily. This can be beneficial, as it will allow you to use the ITCs to recover GST/HST you have paid on business purchases.

Calculating and Charging GST/HST

The GST/HST that you charge is determined by the "rules of the place of supply". Usually, if you are into the HST program and supply goods or services in a province that participates in this scheme, you must charge the rate of the province’s HST. If your transactions are limited within a GST-only province or territory, you bill GST at a 5% rate. Such a case of complexity occurs with cross-country transactions in Canada, where the rate you apply might be dependent upon the residence of your customer rather than the location of your business.

Filing and Remittances

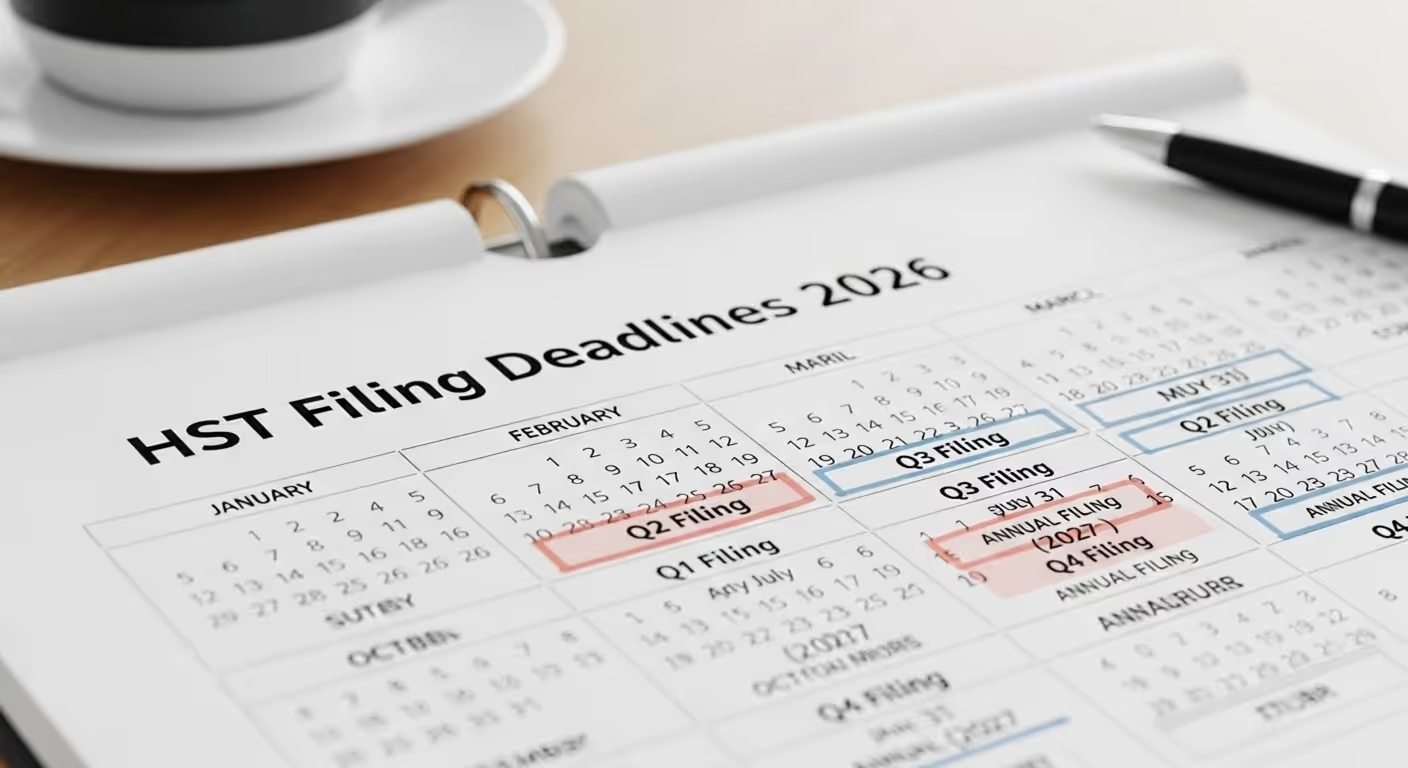

From monthly to quarterly, annual filings of GST/HST can be adjusted, based on revenue and your business’s preference. The integrity of the accounting system depends on the untainted nature of the records kept to report both the GST/HST revenues collected and the ITCs claimed. An accounting firm in Toronto may be considered to be your key partner in this process as it will assist you in your filings, ensure accuracy and maximize the benefit for your tax position.

Input Tax Credits (ITCs)

GST/HST system is advantageous because the ITCs claim that it gives back to the business. Input credit is something a company pays in the form of GST/HST during purchases and expenses while running its trading activities. Managing tax aspects of ITCs can be extremely key for your company to maintain cash flow and lower taxes.

Common Challenges and Solutions

Handling GST/HST can be very complicated as new and growing businesses can figuratively attest. Frequent difficulties to consider are ensuring compliance with registration requirements, which claims can be made and where, and correctly registering each province. Teamwork with competent accounting firms can help resolve the problem by coming up with tailored advice and making sure to comply with rules set by the Canada Revenue Agency (CRA).

The Role of Accounting Firms

An experienced accounting firm in Canada can do more than just tax preparation services. They can participate in strategic planning, the search for exceptions to tax legislation allowing optimization the taxation, and the consultation on highly challenging deals. Their expertise can be particularly valuable in areas such as

GST/HST Registration Advice:

Presenting you with the necessary information on where and when to register.

Compliance and Filing:

Ensuring that the forms and filings are accurate and timely and significantly risking financial penalties.

ITC Optimization:

Using your highest possible claims to maximum positive impact on your financial performance.

Audit Support:

Make sure you are well informed of any contacts from the CRA, including proper representation if its auditors are doing the rounds.

Conclusion

Whether looking to seek help in dealing with GST/HST or getting tips on financing, there is always an expert readily available to provide an answer. Our business team specializes in helping entrepreneurs of different sizes of business to fulfil their tax obligations promptly and without any hassle. Call us today to find out how we can help your business with its specific requirements, so you can have time to concentrate on building profits and success while being confident that your tax compliance is up to the standard.